Mortgage Mate

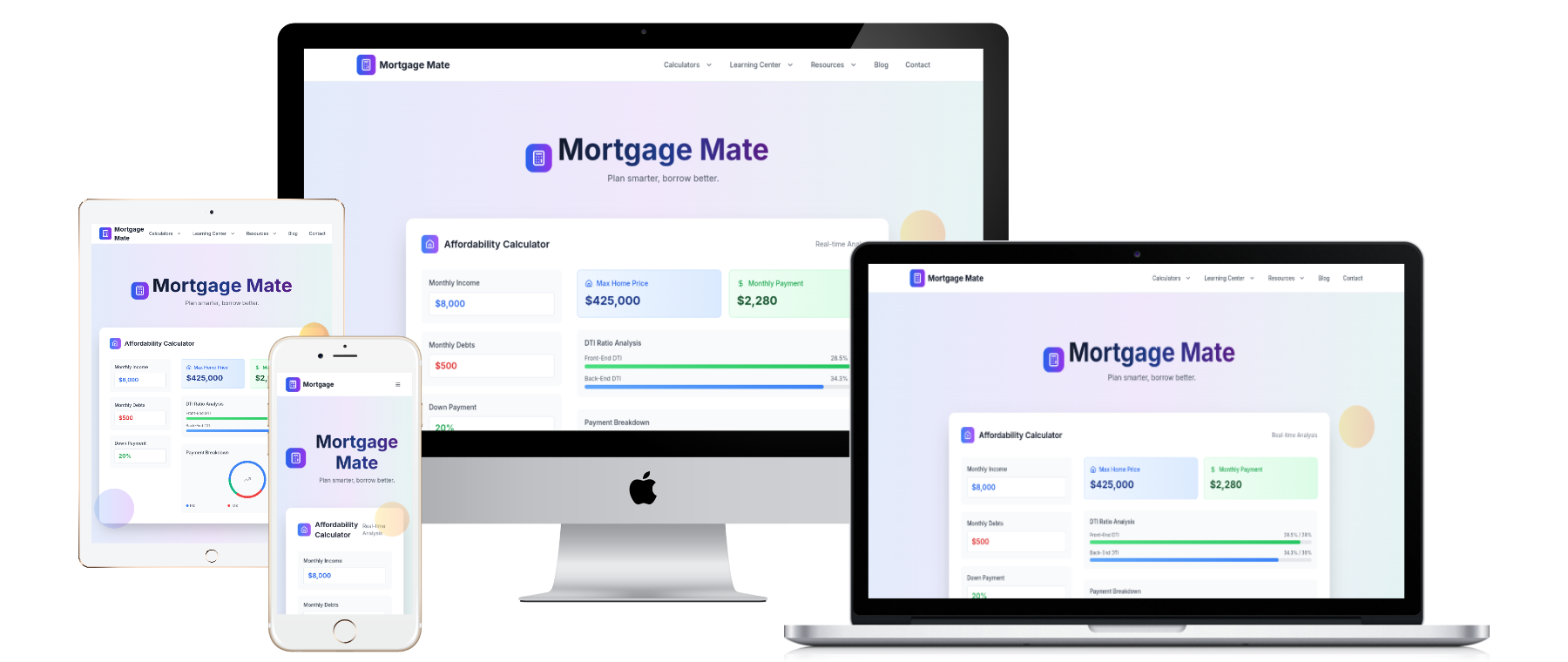

Mortgage Mate is a web app built for the mortgage and real estate finance space. It gives professionals and homebuyers a full set of modern, accurate calculators that can be added to any website with a simple iframe embed.

The platform includes essential tools like a Mortgage Payment calculator and an Affordability calculator, plus advanced options such as Buydown, DSCR, Refinance, Net Proceeds, Rent vs. Buy, HELOC, and Closing Costs. Each calculator delivers instant results with clear visuals, and users never need to create an account or share personal data.

Beyond the calculators, Mortgage Mate features a learning hub filled with mortgage guides, real estate tips, and investment strategies, all connected to a growing blog and resource library. The project shows how we combine finance and technology to make tools that are both powerful and easy to use.

Features

-

Precision and speed Results update instantly as users type. Interactive charts make it simple to see principal, interest, taxes, insurance, and PMI in real time.

-

Security and privacy All calculations run in the user’s browser. No data is stored or sent anywhere else.

-

Full suite of calculators From payments and affordability to refinancing, buydowns, and debt-service coverage, Mortgage Mate covers every step in the process.

-

Professional design The neutral, financial-industry look blends into any site. Charts and breakdowns are formatted for quick understanding.

-

Learning resources Guides, blog posts, and real estate tips extend the platform into a full educational hub.

Timeline

MVP: 4 weeks Project: Ongoing

Team

Creative & Technical

Role

Research, Design & Full-Stack Development

The Challenge

Most mortgage calculators available to the public are either clunky plugins or third‑party links. They rarely match the host site’s look and feel, and many require monthly fees. Worse, the calculations can be inaccurate or oversimplified. In a high‑rate environment—rates on 30‑year purchase mortgages averaged 6.93 % in June 2025 and fluctuated between 5.89 % and 7.15 % over the year; borrowers and professionals can’t afford guesswork. Investopedia notes that mortgage rates are shaped by 10‑year Treasury yields, Federal Reserve policy and competition between lenders, creating volatility that demands precise tools.

As developers, we knew that shoving a one‑size‑fits‑all plugin into a site wasn’t good enough. The market lacked affordable, beautiful calculators that could be easily integrated into any platform. Existing widgets often returned minimal data and forced users to leave the host site—conditions that hurt conversion and user trust.

The Solution

Our team built Mortgage Mate from the ground up with a focus on accuracy, usability, and design. We worked with mortgage professionals to ensure the formulas and ratios match industry standards. The calculators are delivered in a lightweight iframe that developers can embed with a simple copy and paste. The neutral design integrates seamlessly into finance websites, blogs, and portals without clashing with brand colors. Each tool includes professional charts and clear breakdowns, giving users a detailed view of principal, interest, taxes, insurance, PMI, and closing costs.

Complete Calculator Suite

-

Mortgage Payment: Calculates monthly payments with itemized breakdowns.

-

Affordability: Estimates home price ranges using debt-to-income (DTI) ratios across loan types.

-

Buydown: Compares temporary and permanent buydowns with cost-benefit analysis and break-even timelines.

-

DSCR: Evaluates cash flow and debt-service coverage for investment properties.

-

Refinance: Projects savings and break-even points for refinancing scenarios.

-

Net Proceeds: Calculates seller net proceeds, factoring commissions and closing fees.

-

Rent vs. Buy: Compares long-term financial outcomes of renting versus buying.

-

HELOC: Estimates borrowing capacity, payments, and payoff strategies.

-

Closing Costs: Provides state-specific estimates and cost-saving insights.

By offering this complete suite in a unified design, we solved the challenge of scattered, inconsistent tools and gave users a single trusted source for accurate mortgage and real estate calculations.

Design Process

Research

User interviews and analytics review

Design

Wireframes and high-fidelity mockups

Development

React implementation with TypeScript

Testing

User testing and performance optimization

Mobile Experience

Performance matters on every device. Mortgage Mate scores 99/100 on Lighthouse performance testing. Key results include:

-

First Contentful Paint: 1.1 seconds

-

Total Blocking Time: 40 ms

-

Largest Contentful Paint: 2.1 seconds

-

Cumulative Layout Shift: 0 (no layout shifts)

These numbers translate into a fast, responsive experience that feels just as smooth on a smartphone as it does on a desktop.

Responsive Design The calculators adapt to any screen size. On smaller devices, inputs and charts stack vertically for easy scrolling. On larger screens, the layout shifts to side-by-side for quick comparisons. The neutral color palette and clear typography ensure readability in any environment.

Optimized Delivery We optimized the JavaScript bundle so the iframe loads quickly without blocking the host site. This approach improves user engagement and supports SEO.

Results & Impact

Conversion Increase

Significant improvement in overall conversion rate

Faster Load Times

Performance optimization reduced loading times

Pages per Session

Improved user engagement and exploration

Ready to Transform Your Digital Presence?

This project demonstrates our ability to create conversion-focused, user-centered designs that deliver measurable business results. Let's discuss how we can help your business grow.

Similar Project Needs?

We specialize in e-commerce optimization, conversion rate improvement, and modern web applications.

Start a ConversationView More Work

Explore our complete portfolio to see how we've helped other businesses achieve their goals.

Browse Portfolio